This story is a collaboration between CBC News and the Investigative Journalism Foundation (IJF).

A national restaurant company is dropping one of its Ontario franchisees after a foreign worker alleges he paid his own wages for a cook position that didn’t exist.

Quebec-based MTY Food Group says it has given Turtle Jack’s Muskoka Grill in Oakville, Ont. — one of its branded restaurants — 90 days to “leave the [MTY] franchise system” after a joint investigation by CBC and its reporting partner the Investigative Journalism Foundation (IJF) shared allegations of an illegal payroll scheme at the restaurant.

MTY, which owns more than 50 Canadian brands — including Manchu Wok, Baton Rouge, Country Style and Mr. Sub — told CBC/IJF its team met with the franchisee and after “asking clear questions and not receiving clear answers,” a decision was made to terminate the business relationship.

“The type of illegal practices and immoral behaviour described in the allegations you reported to us will not be tolerated by MTY under any circumstances,” said Eric Lefebvre, the company’s CEO, in an emailed statement.

MTY also told CBC/IJF that it is clear the owner of Turtle Jack’s Oakville would not be owning one of their franchises again.

CBC/IJF obtained hundreds of documents that suggest the former Turtle Jack’s employee was caught in a complex immigration scheme.

According to the documents, the man, who is an Indian national, flew into the country in late 2022 with the help of a regulated Canadian immigration consultant.

The man was issued a two-year work permit after presenting a letter from Service Canada confirming his employer was approved to hire two foreign workers as cooks, as well as a job offer signed by the restaurant’s manager.

But WhatsApp exchanges between the worker, his employer and the consultant suggest that after he arrived in Canada, the man was not initially given any hours.

Instead, he says he was told to give his new employer about $3,000 a month in bi-weekly cash payments in order to be added to the restaurant’s payroll, most of which would be paid back into his bank account. He would then be issued paystubs as proof of employment when he applied for permanent residency.

The worker quit in May 2024.

As Canada tightens its path to permanent residency, more immigration schemes are appearing online, offering fake jobs to foreign workers in exchange for up to $45,000.

The Canada Border Services Agency (CBSA), which investigates immigration fraud, told CBC/IJF this type of arrangement is called “payroll cycling.”

Payroll cycling involves the creation of fake documents, like paystubs, by a complicit employer or consultant on behalf of a foreign national. CBSA says it is often used when a foreign national obtains a work permit for a position that doesn’t exist.

Under the Immigration and Refugee Protection Act (IRPA), payroll cycling is a form of misrepresentation, which is illegal for all involved — both the workplace involved in the scheme and any worker who participates in it. Migrants caught misrepresenting themselves, and anyone who advises them to do so, can face fines of up to $100,000 and up to five years of imprisonment.

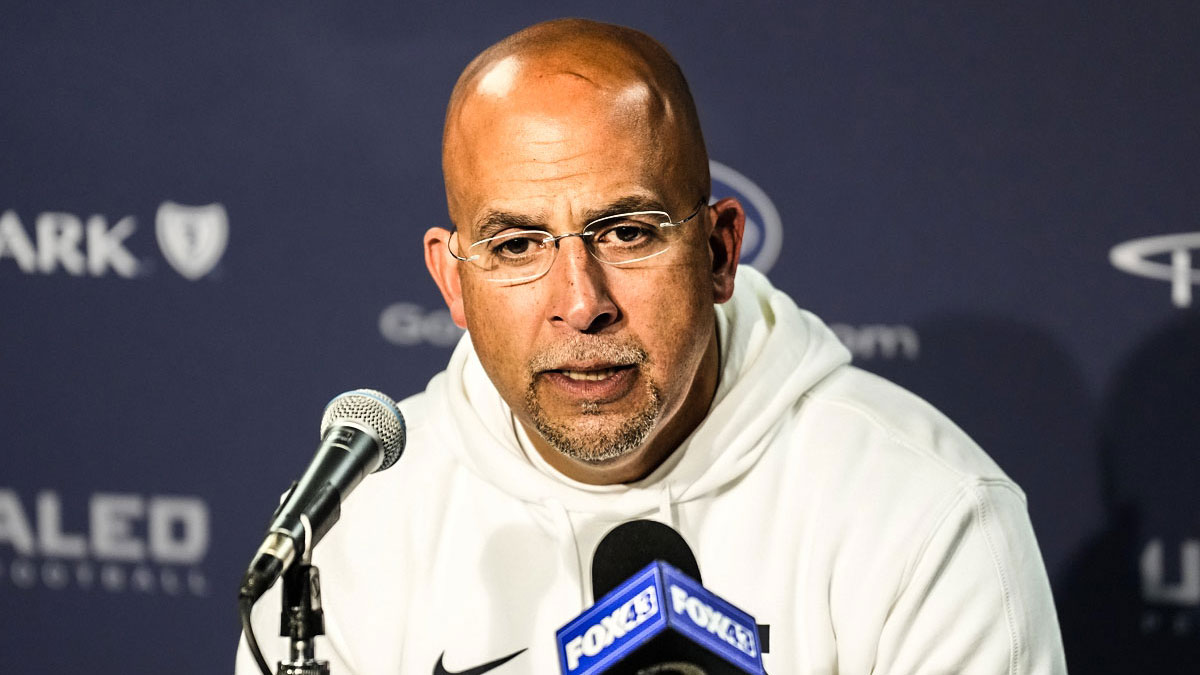

Inderjit Lamba, the general manager at Turtle Jack’s Oakville to whom the foreign worker alleges he made the payments, declined multiple interview requests from CBC/IJF. In an email, Lamba wrote that the allegations by the “former employee” are “unproven, unsubstantiated, and are denied.”

CBC/IJF has reached out to Daljeet Lamba, who is listed as sole director of the corporation operating the Turtle Jack’s Oakville franchise, according to Ontario corporate records. CBC/IJF did not receive a response at this time.

Service Canada, the agency responsible for overseeing the temporary foreign worker program and investigating non-compliant employers, has confirmed it is “conducting compliance activities” at Turtle Jack’s Oakville.

In a statement, Inderjit Lamba wrote that Service Canada has “not at this time informed us of any violations, or negative findings whatsoever.”

Months of payments

CBC/IJF reviewed WhatsApp messages, bank statements, paystubs, work schedules, emails and immigration paperwork spanning the worker’s arrival in Canada up until this summer. The documents reveal the worker made a series of payments to the employer over a period of 16 months.

Regular e-transfers, cash withdrawals and paystubs during that time appear to align with the dates and amounts the worker was asked to pay the employer via WhatsApp messages.

For example, on a Friday in late January 2023, a few weeks after the worker landed in Toronto, his immigration consultant instructed him to make cash payments of $1,471.53 “every two weeks,” starting “this Tuesday.”

Bank statements show cash withdrawals totalling $1,500 that Monday. The next day, the worker received a direct deposit of $1,095.96 from “MTY,” which appears to be a payment from MTY Food Group, the franchisor.

The amount of the direct deposit corresponds with the take-home pay on his paystub, but the cash withdrawals exceed the gross pay of $1,331.20 for that cycle.

A WhatsApp message sent a few weeks later appears to show Inderjit Lamba threatening to take the worker off payroll over a late payment — which would jeopardize his chances of gaining permanent residency, as his closed work permit did not allow him to be employed elsewhere.

“If you are not here today, I will end the pay,” Lamba wrote ahead of one of the cash drop-offs.

Further text messages obtained by CBC/IJF suggest at least one other person was making similar payments to the same employer.

A message from Feb. 24, 2023, that appears to be from Lamba tells the immigration consultant that the former Turtle Jack’s employee “still has not dropped this last Tuesdays [sic] payment,” while another person who also seems to be a temporary foreign worker is “short.”

![A screenshot of a text exchange that reads “Hello, I got [name redacted] payment, she’s short, I told her the amount. [The worker’s name] still has not dropped Tuesday’s payment. I really don’t have time to follow up with them.” A response, in blue, says “Ok I’m sorry about that I’ll let you know.”](https://i.cbc.ca/1.7367466.1730244832!/fileImage/httpImage/image.jpg_gen/derivatives/original_780/lmia-story-other-worker-short.jpg)

WhatsApp screenshots from February 2023 suggest that after the worker said he couldn’t afford to make the payments without being given work hours, Inderjit Lamba referred him to an employment agency to “help with work” under the table for cash.

Time sheets and messages suggest the worker was finally given his first shift at Turtle Jack’s Oakville in March 2023 and worked part-time as a cook for more than a year. Although his name only appears next to weekend shifts in the restaurant’s time sheets, his paystubs continued to show him being paid as though he was working full-time.

Before his first shift, the foreign worker was asked by Inderjit Lamba to “bring payment with you as well,” according to WhatsApp messages. He was later instructed to ask a back-of-house supervisor for an envelope, put the money inside and then ask the back-of-house manager to place it in a box with Lamba’s name on it.

Regarding MTY’s recent actions against Turtle Jack’s Oakville, Inderjit Lamba told CBC/IJF in a subsequent email that the restaurant “has not reached any mutual agreement with the franchise parent company.” Rather, he claimed that MTY said “should CBC air its story, it shall unilaterally decide not to renew our Franchise agreement.”

When asked about this, MTY reiterated the franchisee was “clearly informed that we will not renew his franchise agreement and that he will leave the MTY’s franchise system following our 90-day notice.”

‘A fraud upon the system’: lawyer

After being presented with these allegations, Toronto immigration lawyer Elizabeth Long called the situation “completely illegal” and “a fraud upon the system.”

Beyond the alleged payroll cycling scheme, the Indian national appears to have also been charged other illegal fees before even coming to Canada.

In a WhatsApp exchange months before his arrival, his immigration consultant quoted him $50,000 for a path to permanent residence, to be paid in five instalments.

One of these payments was a fee for “LMIA approval,” referring to a Labour Market Impact Assessment, a document issued by the federal government that allows employers to hire temporary foreign workers when they cannot find qualified Canadians or permanent residents for a job.

The price tag is similar to LMIA-supported positions advertised for cash by online sellers also uncovered by the CBC/IJF investigation.

$15K in cash for employer

CBC/IJF showed Calgary-based immigration lawyer Jatin Shory the WhatsApp messages breaking down the costs quoted to this foreign worker. The $50,000 included $15,000 that the consultant told him to pay — in cash and intended for his future employer — before leaving India.

“It’s disgusting. Fifty thousand dollars — that makes absolutely no sense,” Shory said.

The worker says he paid $45,000 of the $50,000. CBC/IJF were able to verify some but not all of these payments.

Shory called it a “joke” that consultants can get away with charging such high fees. Furthermore, all LMIA-related costs incurred in the process of recruitment or hiring, lawyers stress, should be charged to the employer, not the foreign worker.

“The LMIA is not allowed to be charged to the applicant, to the employee,” said Long.

Anyone who charges workers for an LMIA is “breaking the law and taking advantage of vulnerable people,” Employment and Social Development Canada (ESDC) said in a statement.

Long said foreign workers may be tempted to participate in these schemes because if they can prove Canadian work experience, “their chances for getting permanent residence is so much higher.”

Besides being one way for foreign nationals to legally work in Canada, LMIAs boost foreigners’ chances of obtaining permanent residency, because they add more points to the eligibility score needed for a successful application.

But she explained that a migrant in this situation would also be misrepresenting their work experience to immigration authorities, making them complicit in a crime under the IRPA and placing them at greater risk of deportation if discovered.

“This is basically what a lot of desperate people are doing in order to be able to stay and get permanent residence,” Long said.

LMIAs may become even more valuable in the near future after the federal government announced last Thursday that it would be slashing the number of permanent residency spots starting next year. The move will make the race for permanent residency even more competitive for the 2.8 million temporary residents currently living in Canada.

Rise in permits for vulnerable workers

The foreign worker has since been granted an open work permit for vulnerable workers by the Canadian government, through a program started in 2019 that provides a pathway for temporary foreign workers who have been abused or are at risk of workplace abuse to find work with other employers.

Tatjana Boxhorn, an Alberta-based immigration consultant, says she has filed more than 800 successful pro bono applications for vulnerable migrants, and “pretty much every single one” involved victims of similar LMIA schemes.

She said federal authorities all know about these schemes, but “nobody does anything about it.”

“I have one particular employer that I have reported with 17 temporary foreign workers. Seventeen. And they’re still getting LMIAs,” said Boxhorn.

“Frankly, they are … literally allowing modern slavery to take place.”

Canada is ‘allowing modern slavery’ by not addressing fraud within the temporary foreign worker program, says Tatjana Boxhorn, a regulated Canadian immigration consultant who has filed hundreds of applications to allow vulnerable migrants to escape workplace abuse.

Boxhorn said because LMIA-approved positions are tied to one specific employer, abuse is rampant, adding that even after being granted an open permit and leaving their employer, some workers are still too afraid to report the fraud to authorities.

“I have seen a wide array of abuse going on, from psychological to monetary to sexual abuse,” she said.

Because of those concerns, Boxhorn says looking at the number of open work permits granted is the best indicator of vulnerable workers in the country.

According to figures provided by Immigration, Refugees and Citizenship Canada, the number of vulnerable open work permits granted to foreign workers has more than tripled, from 589 in 2020 to 2,036 in 2023.

So far in 2024, more than 2,700 of these permits were granted — the most in any year since the permits were introduced.

As for those who operate these schemes, 153 individuals in approximately 80 cases have been charged for “unauthorized consultant-related offences” in the last five years, CBSA wrote in a statement. Most offenders, it said, were Canadian citizens or permanent residents.

ESDC has penalized 135 employers of foreign nationals for non-compliance in the past year. The highest financial penalty ever imposed on an employer was $365,700 in April, against a New Brunswick fish processing plant.